Payments for direct investments worldwide have sharply decreased.

In 2024, private equity funds were only able to cash out half of the value of the investments they usually sell. For the third year in a row, payments to investors are decreasing due to deal issues caused by the drought.

According to the Financial Times, funds typically sell 20% of their investments annually. However, industry leaders anticipate that this year's cash payouts will amount to approximately half of the usual figure. This is reported by Ekonomichna Pravda.

It is noted that over the last three years, funds have missed out on about $400 billion in payouts to their investors, which is significantly lower than average figures.

Such data indicates growing pressure on companies that are forced to find ways to return funds to investors, including exiting investments in the next year.

Since the beginning of 2022, firms have been trying to strike deals at more favorable prices, resulting in increased financing costs and decreased corporate valuations.

Read also

- The Influence of Trump on Putin and Weapons from the USA - Morning.LIVE Broadcast

- The enemy dropped guided bombs on buildings in Sumy — footage of the aftermath from the State Emergency Service

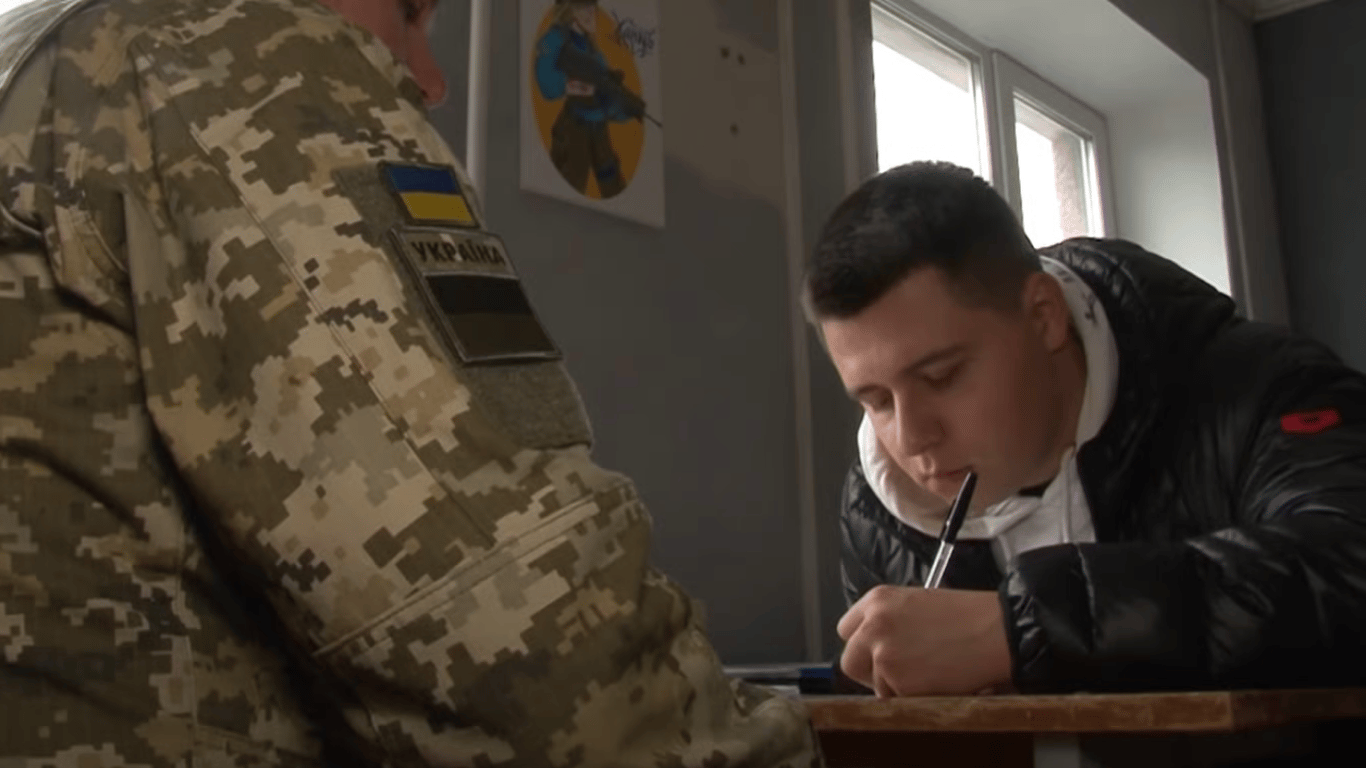

- TCK has returned the registered citizen - how to correct the situation

- Six Additional Payments - What Military Personnel Will Receive in August

- Kellogg's visit proved that Putin fears the US, - statement by Andriy Sibiga

- Does a 'second passport' exempt from mobilization — the lawyer answered