Why the NBU Allowed the Weakening of the Hryvnia: Pyshnyi Explained the Regulator's Strategy.

The National Bank of Ukraine (NBU) explained the reasons and consequences of the weakening of the hryvnia a year after transitioning to a managed exchange rate flexibility regime.

According to Andriy Pyshnyi, the head of the NBU, such a change in the exchange rate positively affected the economy during the war.

"This occurred against the backdrop of a combination of exogenous factors (longer and more intensive war, destruction of energy infrastructure, rumors of a "default"), easing of monetary policy and currency restrictions by the National Bank, which was critically important for businesses and stimulating economic activity," explained Pyshnyi the reasons for the hryvnia's weakening.

The hryvnia fell against the dollar by almost 13% on the official market and by 9% on the cash market. This weakening happened due to the war and the easing of monetary policy.

However, according to Pyshnyi, this exchange rate dynamic also had positive consequences. Inflation over the year met the regulator's target of 5%. The trade deficit decreased from $24.5 billion to $22.2 billion. Also, assets in the national currency remained attractive.

Pyshnyi reminds of the high rates on hryvnia deposits and bonds. Last year, rates reached up to 12% on deposits and 19% on bonds.

Read also

- The Sumy Regional Military Administration denied information about a possible evacuation of the city

- The General Staff responded to Russia's statement about a breakthrough in Dnipropetrovsk

- Ukrainians warned about a new massive attack from the Russian Federation: Kyiv and 8 other regions at risk

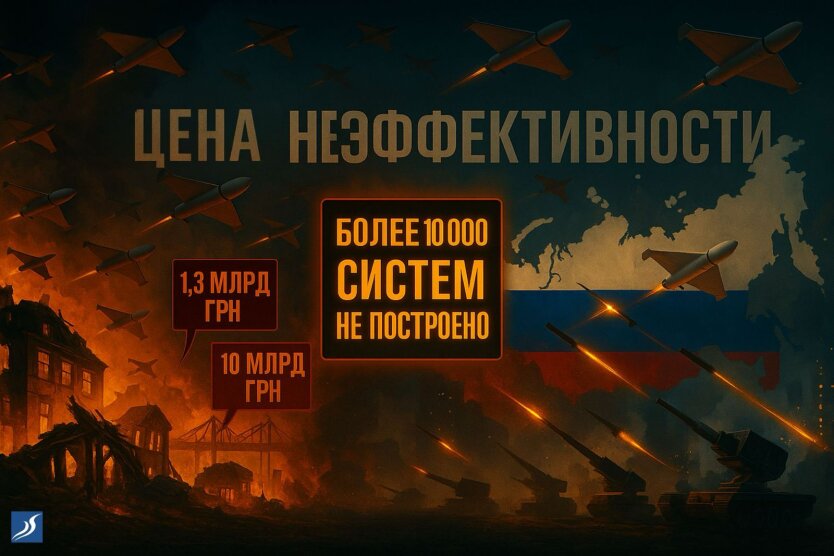

- The Cost of Inefficiency: Large-Scale Russian Attacks Require Large-Scale Organizational Responses from Ukraine

- War may come to us: the head of the Czech Republic issued a troubling warning

- Zelensky: The USA unexpectedly sent missiles intended for Ukraine to another country